CÔNG TY TNHH SCANWELL LOGISTICS VIỆT NAM

Scanwell Logistics được thành lập vào năm 1981, có trụ sở chính đặt tại Hồng Kông. Trong hơn 35 năm qua, chúng tôi đã phát triển để trở thành một trong những công ty lớn nhất về dịch vụ vận tải và giao nhận, là thành viên được hiệp hội IATA hoàn toàn tín nhiệm. Chúng tôi có hệ thống chi nhánh tại hầu hết các châu lục như: Châu Mỹ, Châu Á, Châu Âu, Châu Úc … và hàng trăm đại lý ở các thành phố lớn trên toàn thế giới, mục đích tạo điều kiện thuận lợi nhất trong việc kiểm soát chất lượng dịch vụ và sự an toàn trong chuyên chở hàng hóa.

Dịch vụ

VẬN TẢI BIỂN

Scanwell Logistics là một trong những NVOCC lớn nhất tại Hong Kong, với hơn 30 năm kinh nghiệm vận tải đường thủy gồm LCL (hàng lẻ) và FCL (hàng container).

VẬN TẢI HÀNG KHÔNG

Scanwell Logistics hân hạnh là thành viên của hiệp hội vận tải hàng không Quốc Tế (IATA), sở hữu dày dặn kinh nghiệm trong vận tải hàng hóa hàng không.

DỊCH VỤ KHO BÃI

Hiện đang vận hành các kho dịch vụ và kho ngoại quan tại trung tâm TP.. HCM và các vùng lân cận như Biên Hòa, Đồng Nai, Nhơn Trạch, v.v.

PHÂN LOẠI VÀ ĐÓNG GÓI

Scanwell được trang bị hệ thống thông tin quản lý kho toàn diện có thể cung cấp các giải pháp hậu cần chuỗi cung ứng toàn diện cho quý khách hàng.

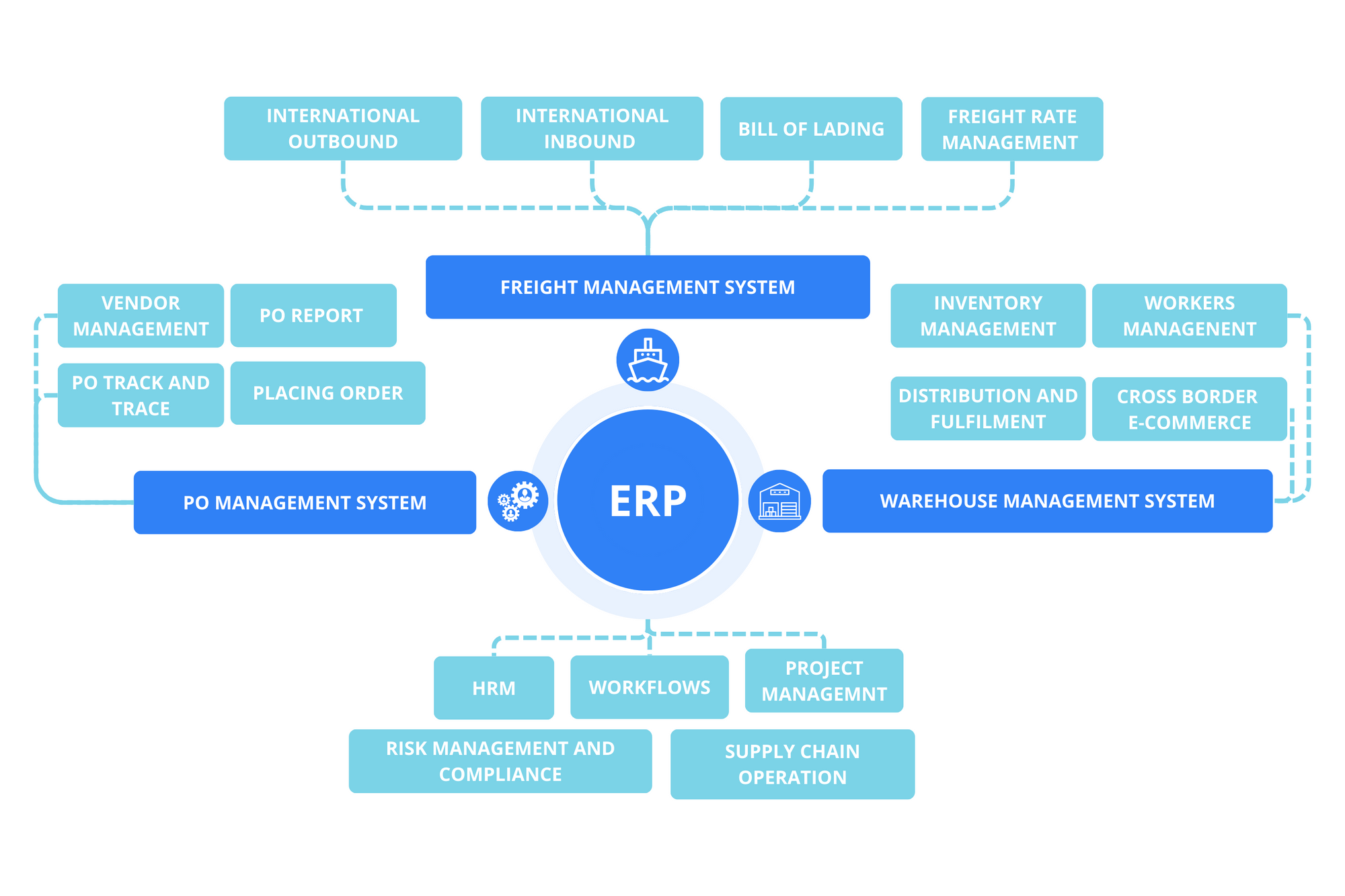

MANAGEMENT SYSTEM

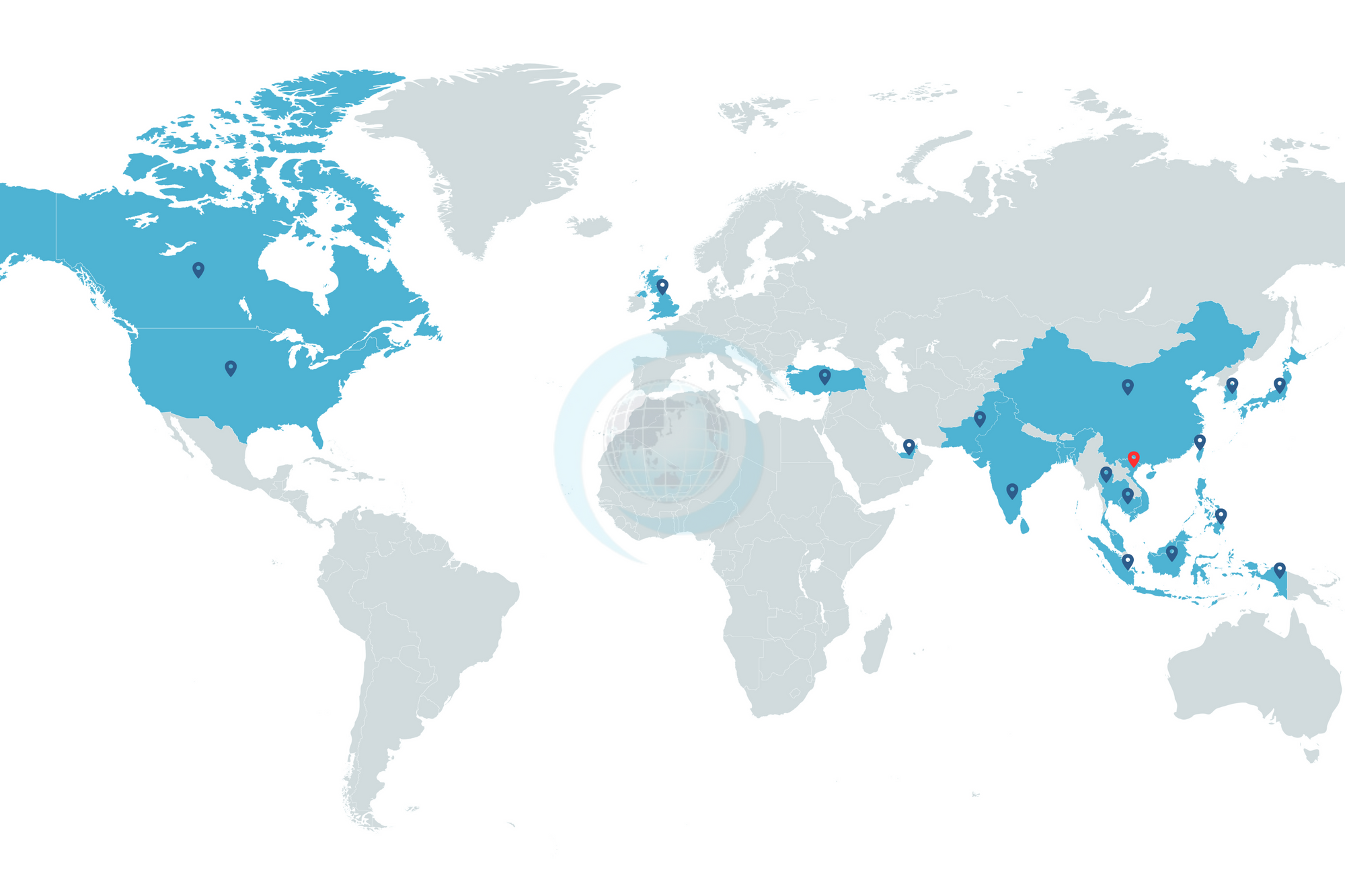

NETWORK

ASIA Offices

-

Hong Kong - Headquarters

Bangkok, Thailand

Cebu, Philippines Manila, Philippines

Hanoi, Vietnam Ho Chi Minh City, Vietnam

Haiphong, Vietnam Kuala Lumpur, West Malaysia

Penang, West Malaysia Jakarta, Indonesia

Surabaya, Indonesia Phnom Penh, Cambodia

Pusan, Korea Seoul, Korea

Singapore Taipei, Taiwan

Tokyo, Japan

CHINA Offices

-

Shanghai

Beijing

Dalian Fuzhou

Guangzhou Nanjing

Ningbo Qingdao

Shenzhen Shenzhen Airport

Tianjin Xiamen

EUROPE & MIDDLE EAST Offices

-

Felixstowe, United Kingdom

Hounslow, United Kingdom

Istanbul, Turkey Ankara, Turkey

Ataturk Airport, Turkey Bursa, Turkey

Canakkale, Turkey Derince, Turkey

İskenderun, Turkey Izmir, Turkey

Mersin, Turkey Urfa, Turkey

Dubai, United Arab Emirates

WEST ASIA Offices

-

Bangalore - India Head Office

Chennai (Madras), India

Coimbatore/Tirupur, India Delhi, India

Hyderabad, India Kolkata, India

Mumbai, India Tuticorin, India

Vizag, India Colombo, Sri Lanka

Chittagong, Bangladesh Dhaka, Bangladesh

Faisalabad, Pakistan Karachi, Pakistan

Lahore, Pakistan

NORTH AMERICA Offices

-

Atlanta, US

Chicago, US

Columbus, US Los Angeles, US

Minneapolis, US Miami, US

New York, US San Francisco, US

Montreal, Canada Toronto, Canada

Hiệp hội đối tác